Scenario:

Payment Frequency: Salaried employees paid monthly

Joining date: Various dates after the 15th of the month. For the purposes of this document, we will assume that the salary will be paid in January

Desired Outcome: Employees' paid a semi-monthly salary payment for the first month and paid the correct monthly salary in all subsequent months

Issue #1: Some deductions, such as Social Security and National Health Insurance, have maximum limits. When a new employee is added, with a contract date of the 28th of January, the maximum insurable salary is calculated from the contract date to the end of the month which leads to an incorrect deduction being calculated.

Issue #2: Because all employees are setup as Monthly paid employee, BoVi HR returns the full month's salary for January and not the desired semi-monthly salary for the first month.

Problem: The Contract Start date is automatically used as the Salary Effective date. The maximum insurable amount is based on the salary Salary Effective date and hence the calculation for new employees added is not correct.

* Employers with contract start dates at the beginning of the Payment Frequency period will not have this issue.

* A Pay Period Deduction can easily reduce the amount owed in any period. The issue with this setup is that Contract/Salary Date provides is an issue for the maximum insurable amounts.

Solution

Change the employee's salary and Salary Effective date to 1st of the January

1. Edit the Employee and change the employee's salary to the semi-annual amount. In our example, the semi-annual amount is $750.

2. Update the Salary Effective Date to coincide with the period the payment frequency period. In this example, the employees are paid monthly so we will set the Salary effective date to January 1st 2022

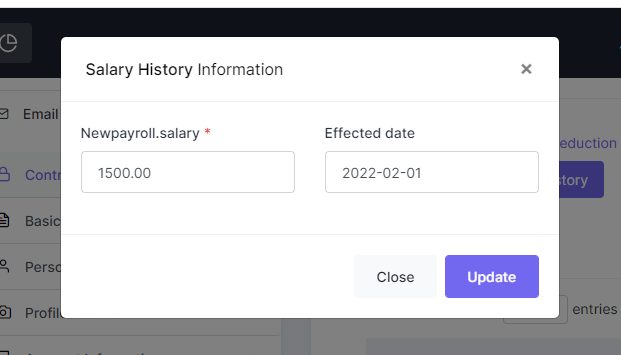

3. Under the Salary History tab, edit the date of the the original salary amount to begin on the first day of the new period. In this particular case, because the employees are monthly, we will update the Salary Effective date under the salary history tab to the 1st of February.

Payroll Tax (BVI)

4. At the time of writing, there is not a setting which allows an employee to be labeled as having passed the $10,000 Payroll threshold. To achieve this functionality, the client should enable to 'second job' option as shown below in the Employee/Contract section. Because all employees who work a second job are required to pay to the full payroll tax on the complete salary, this option will automatically deduct the 8% payroll tax from the employee's salary.