From time to time, there may be an employment arrangement which is not standard. For example, a student may be employed who is not required to pay NHI (BVI) taxes because the government pays the full NHI contributions in full. There may also be circumstances where tax deductions are not removed from a contract or temp worker's salary. We strongly advise for exemption be confirmed with the Department of Labour.

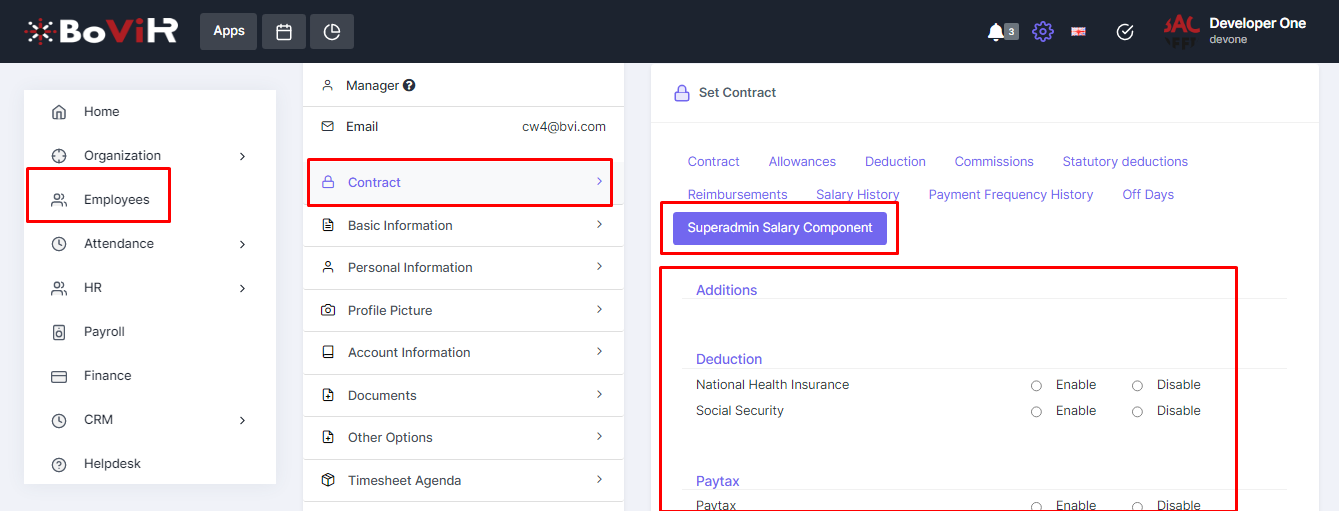

To remove tax deductions from a particular employee, go to Employees > View Employee Details > Contracts > Super Admin Salary Components. Enable and disable to specific deductions for each employee.